The original Martingale Strategy in a Casino involves doubling the trade size every time a loss is faced. A classic scenario for the strategy is to try and trade an outcome with a 50% probability of it occurring. The scenarios are also called zero expectation scenarios.

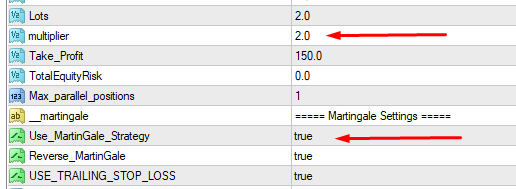

Just think about entering a casino go to a Roulette Table and set 100 USD on RED. The Martingale game is based on the fact that if you lose a bet on a color, the stake is doubled until a win is achieved. If you win, your stake is doubled. OK. First Result is BLACK. You lost 100 USD. Now you double your input to 200 USD (Martingale factor is 2.0) and again set everything on RED. Result is BLACK. Now you lost in total 300 USD, since you lost twice.

Just think about entering a casino go to a Roulette Table and set 100 USD on RED. The Martingale game is based on the fact that if you lose a bet on a color, the stake is doubled until a win is achieved. If you win, your stake is doubled. OK. First Result is BLACK. You lost 100 USD. Now you double your input to 200 USD (Martingale factor is 2.0) and again set everything on RED. Result is BLACK. Now you lost in total 300 USD, since you lost twice.

In the third round you double your deployment again to 400 USD, set everything on RED and the Result is RED. Now you will receive the double stake of 400 USD, so 800 USD. You have to subtract your losses of already 300 USD and your last input of 400 USD and thus maintain a total profit of 100 USD then.

If you would also loose round 3, then your loss would accumulate to 700 Dollars. You would then need to set your input to 800 USD in round number 4. This time you will win. You will receive 1,600 USD from the Casino, but you have to subtract your losses of already 700 USD and your last input of 800 Dollars, so that your profit will be one hundred Dollars.

So far so good. Statistically it is possible that you can loose very often, before you will win your first time, so in reality Martingale is dangerous, because if your account is too small, it might be easily happen, that you run out of money (margin) before your first win will show up, especailly if you choose a Martingale factor of 2.0 or even higher.

Furthermore in such a "multiplier 2.0 scenario" you can see that you quickly come to a situation where you need a lot of money to cover your losses whereas the profit that will be achieved is fairly small in comparison. With a 100 Dollar start you needed already 800 Dollars in round 4. If you would continue to do so and you would have a "bad series" you would need more than 100,000 Dollars in round 10 just to cover your profit of 100 Dollars...

Coming from the Casino theory to the Expert-Advisor in a trading scenario.

The PowerScalper bot handels the Martingale escalation management based on the actual market conditions. There is a switch to switch Martingale to "Revers-Mode" which means that the first Martingale trade that is being opened into the opposite direction of the initial trade. Let's assume that your initial trade was a 1 Lot long (Buy) position and you have set your multiplier to 2.0 and Martingale is switched to ON and in Revers-Mode.

After a certain amount of a falling market Martingale will kick in and open a 2 Lot short (Sell) position for you fully automatically, just as in our example in the casino your market exposure now is 3 Lot. instead of 1 Lot. 1 Lot long and 2 Lot short. Now you have two open positions. So this is kind of a "hedge" into the opposite trading direction. If the market will continue to fall Martingale functionality will probably open further short positions for you, which means that your risk exposure is even rising, since if it opens another 2 lot short position your exposure grows to 5 lot in total with three simultaneous open positions.

In case of a market reversal and all those positions open, Martingale will escalate to a second stage in which it doubles the lot value once more to 4 lot. But this time back into long direction, since the market is reversing. If we would receive another market reversal we would enter in escalation stage number 3 going short again. This time with 8 lot, since Martingale multiplier is set to 2.0 and this means it goes from 2 to 4 to 8 lot.

And so on on and so on. In theorie, if you would have infinite money in your account and the market would behave from one reversal into another Martingale would escalate back and forth by doubling your stakes all time. You see that this can lead very fast to a huge market exposure that will also be dangerous to bigger and even huge accounts. We have seen Martingale values in our test scenarios that have reached lot sizes of 160 lot/trade. Only a very little amount of people would trade something like this in reality with real money since it is too dangerous.

So, if there is money and the situation is not resolved as of yet, the bot keeps on trading trying to solve the situation for you.

The total process will only be stopped if the summarized win positions have overcome the summarized loss positions. In this moment the Martingale process will directly close all positions together and take the profit.

Hint: When you are trading on an ECN account doubling the lot size means also doubling your commission that you have to pay to the broker. So commission is also growing quite fast in a longer Martingale scenario. And commission can make a real difference since those accumulate as well to higher numbers.

Beginners and people with small accounts need to work with small lot sizes. The smallest lot size that the system will accept is 0.01 lot. Let's see how such a system would behave over many escalation stages, when Martingale is active and in Reverse- Mode.

Original trade example given 0.01 lot long (Buy)

Market is falling

Martingale escalation stage 1 opens a 0.02 lot position in short (Sell) direction

Market is climbing

Martingale escalation stage 2 opens a 0.04 lot position in long (Buy) direction

Martingale escalation stage 3 opens a 0.08 lot position in short (Sell) direction

Martingale escalation stage 4 opens a 0.16 lot position in long (Buy) direction

Martingale escalation stage 5 opens a 0.32 lot position in short (Sell) direction

Martingale escalation stage 6 opens a 0.64 lot position in long (Buy) direction

Martingale escalation stage 7 opens a 1.28 lot position in short (Sell) direction

Martingale escalation stage 8 opens a 2.56 lot position in long (Buy) direction

Martingale escalation stage 9 opens a 5.12 lot position in short (Sell) direction

Martingale escalation stage 10 opens a 10.24 lot position in long (Buy) direction

This is not the final stop, if the account would still have money and the profit will still not have overcome the Drawdown and the market would continue to change directions it will escalate further.

The example theory shows that even if you start with the smallest amount possible of 0.01 lot that a Martingale multiplier of 2.0 can lead very fast to high lot numbers.

If your account is too small in "free margin" your broker will not accept another escalation stage, so that the system is stopped out and can't open another position.

Apart from this it nearly never happens that a scenario like this escalated over 10 stages with only one trade open in each stage. There are more scenarios where Martingale opens several positions in one and the same escalation stage because the market is not reversing but instead continues to climb or continues to fall into the same direction.

If you would also loose round 3, then your loss would accumulate to 700 Dollars. You would then need to set your input to 800 USD in round number 4. This time you will win. You will receive 1,600 USD from the Casino, but you have to subtract your losses of already 700 USD and your last input of 800 Dollars, so that your profit will be one hundred Dollars.

So far so good. Statistically it is possible that you can loose very often, before you will win your first time, so in reality Martingale is dangerous, because if your account is too small, it might be easily happen, that you run out of money (margin) before your first win will show up, especailly if you choose a Martingale factor of 2.0 or even higher.

Furthermore in such a "multiplier 2.0 scenario" you can see that you quickly come to a situation where you need a lot of money to cover your losses whereas the profit that will be achieved is fairly small in comparison. With a 100 Dollar start you needed already 800 Dollars in round 4. If you would continue to do so and you would have a "bad series" you would need more than 100,000 Dollars in round 10 just to cover your profit of 100 Dollars...

Coming from the Casino theory to the Expert-Advisor in a trading scenario.

The PowerScalper bot handels the Martingale escalation management based on the actual market conditions. There is a switch to switch Martingale to "Revers-Mode" which means that the first Martingale trade that is being opened into the opposite direction of the initial trade. Let's assume that your initial trade was a 1 Lot long (Buy) position and you have set your multiplier to 2.0 and Martingale is switched to ON and in Revers-Mode.

After a certain amount of a falling market Martingale will kick in and open a 2 Lot short (Sell) position for you fully automatically, just as in our example in the casino your market exposure now is 3 Lot. instead of 1 Lot. 1 Lot long and 2 Lot short. Now you have two open positions. So this is kind of a "hedge" into the opposite trading direction. If the market will continue to fall Martingale functionality will probably open further short positions for you, which means that your risk exposure is even rising, since if it opens another 2 lot short position your exposure grows to 5 lot in total with three simultaneous open positions.

In case of a market reversal and all those positions open, Martingale will escalate to a second stage in which it doubles the lot value once more to 4 lot. But this time back into long direction, since the market is reversing. If we would receive another market reversal we would enter in escalation stage number 3 going short again. This time with 8 lot, since Martingale multiplier is set to 2.0 and this means it goes from 2 to 4 to 8 lot.

And so on on and so on. In theorie, if you would have infinite money in your account and the market would behave from one reversal into another Martingale would escalate back and forth by doubling your stakes all time. You see that this can lead very fast to a huge market exposure that will also be dangerous to bigger and even huge accounts. We have seen Martingale values in our test scenarios that have reached lot sizes of 160 lot/trade. Only a very little amount of people would trade something like this in reality with real money since it is too dangerous.

So, if there is money and the situation is not resolved as of yet, the bot keeps on trading trying to solve the situation for you.

The total process will only be stopped if the summarized win positions have overcome the summarized loss positions. In this moment the Martingale process will directly close all positions together and take the profit.

Hint: When you are trading on an ECN account doubling the lot size means also doubling your commission that you have to pay to the broker. So commission is also growing quite fast in a longer Martingale scenario. And commission can make a real difference since those accumulate as well to higher numbers.

Beginners and people with small accounts need to work with small lot sizes. The smallest lot size that the system will accept is 0.01 lot. Let's see how such a system would behave over many escalation stages, when Martingale is active and in Reverse- Mode.

Original trade example given 0.01 lot long (Buy)

Market is falling

Martingale escalation stage 1 opens a 0.02 lot position in short (Sell) direction

Market is climbing

Martingale escalation stage 2 opens a 0.04 lot position in long (Buy) direction

Martingale escalation stage 3 opens a 0.08 lot position in short (Sell) direction

Martingale escalation stage 4 opens a 0.16 lot position in long (Buy) direction

Martingale escalation stage 5 opens a 0.32 lot position in short (Sell) direction

Martingale escalation stage 6 opens a 0.64 lot position in long (Buy) direction

Martingale escalation stage 7 opens a 1.28 lot position in short (Sell) direction

Martingale escalation stage 8 opens a 2.56 lot position in long (Buy) direction

Martingale escalation stage 9 opens a 5.12 lot position in short (Sell) direction

Martingale escalation stage 10 opens a 10.24 lot position in long (Buy) direction

This is not the final stop, if the account would still have money and the profit will still not have overcome the Drawdown and the market would continue to change directions it will escalate further.

The example theory shows that even if you start with the smallest amount possible of 0.01 lot that a Martingale multiplier of 2.0 can lead very fast to high lot numbers.

If your account is too small in "free margin" your broker will not accept another escalation stage, so that the system is stopped out and can't open another position.

Apart from this it nearly never happens that a scenario like this escalated over 10 stages with only one trade open in each stage. There are more scenarios where Martingale opens several positions in one and the same escalation stage because the market is not reversing but instead continues to climb or continues to fall into the same direction.

Hint: There is another good strategy possible: If you decide to use Martingale then you should consider to use it together with the DNPT functionality of the Monitoring + Control Bot, because the Dynamic Net Profit Taker watches the whole time if your considered trading target will be reached and if yes it closes all trades fully automatic and switches Autotrading OFF to secure the profit for you. So the DNPT is always capable to pull the socket and stop Martingale accordingly once it has achieved the daily target that you configured.

The PowerScalper trading bot has the possibility to set a smaller Martingale Multiplier of example given 1.1 or 1.2 then you would not double your stakes in a Martingale case you would only increase it by 10 or 20% instead. This might lower your risk, but also might ensure that your desired target will be achieved later.

In general:

Disclaimer:

This is not an instruction manual, but merely an explanation of how the software works. As the manufacturer of the software, we want you as a user to better understand how the software works.

We are not saying that you should use this functionality with real money. Think very carefully about whether you want to use the functionalities mentioned in the text at your own risk and what risk you are taking.

If you decide to use these functions with real money, you should have tried out how the whole functionality works and what can happen with a demo account for a sufficiently long time beforehand. This is the only way to learn to independently assess the real risks and potential profits.

This is absolutely necessary in order to deal with the risk with foresight. As the manufacturer, we accept no liability if money is lost at the broker due to the functions mentioned in the text. The above-mentioned functions of our software offer you excellent opportunities to make profits, but with the acceptance of the risks that the markets always present.

Every PowerScalper license offers one demo and one real trading license to you. This is our contribution to you, so that you can learn to trade riskless as long as you want, before you are using real money.

The PowerScalper trading bot has the possibility to set a smaller Martingale Multiplier of example given 1.1 or 1.2 then you would not double your stakes in a Martingale case you would only increase it by 10 or 20% instead. This might lower your risk, but also might ensure that your desired target will be achieved later.

In general:

- Using Martingale is a trading strategy that involves additional risk, since it increases your stake in the market

- This risk can be significantly higher than working without Martingale

- Martingale has the possibility to bring you fast from a loosing position into a winning position, if everything goes well and the profit overcomes the drawdown.

- Martingal changes its trading direction with every escalation stage

- The Reversal switch brings it to the opposite trading direction in escalation stage 1

- It can be beneficial to combine Martingale and DNPT of the Monitor + Control EA together

- If you really want to use such scenarios go and test them in a demo account, before you use them with real money

Disclaimer:

This is not an instruction manual, but merely an explanation of how the software works. As the manufacturer of the software, we want you as a user to better understand how the software works.

We are not saying that you should use this functionality with real money. Think very carefully about whether you want to use the functionalities mentioned in the text at your own risk and what risk you are taking.

If you decide to use these functions with real money, you should have tried out how the whole functionality works and what can happen with a demo account for a sufficiently long time beforehand. This is the only way to learn to independently assess the real risks and potential profits.

This is absolutely necessary in order to deal with the risk with foresight. As the manufacturer, we accept no liability if money is lost at the broker due to the functions mentioned in the text. The above-mentioned functions of our software offer you excellent opportunities to make profits, but with the acceptance of the risks that the markets always present.

Every PowerScalper license offers one demo and one real trading license to you. This is our contribution to you, so that you can learn to trade riskless as long as you want, before you are using real money.